Disclosure: I am long SMTP.OB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

At Spruce Point Capital Management, we were recently screening for attractive microcaps with relatively low risk business models, experiencing above market growth, having solid, debt-free balance sheets offering downside protection, high insider ownership, and potential catalysts that could result in significant upside potential. The one company that fit our criteria perfectly is SMTP, Inc. We believe the investment opportunity offers an attractive risk/reward, and we recently became a shareholder.

SMTP (SMTP.OB) is a provider of cloud-based services to facilitate email deliverability that includes bulk and transactional sending, reputation management, compliance auditing, abuse processing and issue resolution. The services provide customers with the ability to increase the deliverability of email with less time, cost and complexity than handling it themselves.

Key Investment Highlights for Potential Investors to Consider are the Following:

Large and Growing Market Opportunity

- The annual U.S. market spend by large and small enterprises is estimated by Forrester Research to be $1.5 billion (growing 12% p.a.) for trusted email marketing solutions that reduce the time, cost, and complexity of managing mass mail campaigns.

- Equally as important are solutions which ensure that emails are received by intended recipients (reducing bounce rates), have value-added analytics, and comply with increasingly stringent regulatory requirements.

- Because the market is large and growing, and the needs of large enterprises differ from smaller businesses, the competition is broad and fragmented with no single dominant solution provider offering solutions to every possible segment. This allows SMTP to focus on a small slice of the market, which involves mission-critical delivery services.

Attractive Business and Financial Profile

- SMTP has a diversified client base of over 8,500 clients. Owning the SMTP.com domain name has been a valuable asset -- the client base has grown organically, with 80% of customers reaching them directly through internet searches. This reduces customer acquisition costs from more expensive third party referrals.

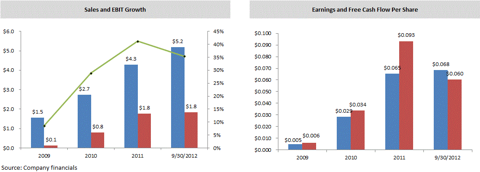

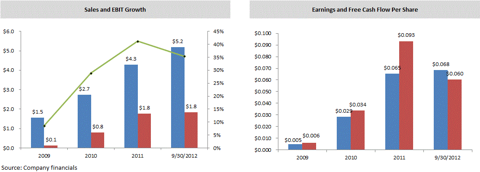

- With an experienced management team and laser focus on growing the business, revenues have jumped from just $0.8 million in FY 2008 to $5.2 million as of LTM 9/30/12 - representing a 16.8% CAGR.

- Given the company's simple, SaaS-like model, Gross and EBITDA margins are 77% and 35%, respectively as of LTM 9/30/12. The company's high EBITDA margins are a function of their extreme focus on cost discipline, while retaining a small entrepreneurial environment. Management is based in Cambridge, MA but SMTP has 25 - 35 contractors in the Ukraine that handle technical support, engineering, R&D, and other administrative functions.

- The company is extremely capital efficient and has generated $900,000 of net income on average equity of just $850,000 in the last twelve months. This translates into a Return on Equity of 106%.

- For above average industry growth, the valuation is cheap at just 12.8x and 7.1x 2013E EPS and EBITDA.

Shareholder Friendly Policies and Strong Insider Ownership

- The impressive management team includes Chairman/CEO Semyon Dukach as the largest shareholder. He's an MIT graduate, a proven entrepreneur, and member of the world famous MIT Blackjack team. Insiders and founders own a majority of the shares, which provides a strong alignment of interests with shareholders.

- The company has historically been shareholder friendly, and has decided its main use of excess cash flow will go toward paying shareholders dividends. In April 2012, the company announced a $1.4m special dividend and initiated a quarterly dividend policy.

- With business continuing to be strong, at the end of October, SMTP announced a 20% dividend increase to 1.8 cents per quarter or 7.2 cents per year. Assuming a share price of $1.15, current investors are receiving an attractive 6.3% dividend yield (425bps more than a 10yr treasury).

Potential Takeover Target Offering Upside

- On October 31st, SMTP announced it had retained Bowen Advisors as its investment bank to pursue strategic alternatives for maximizing shareholder value. We believe this sends a strong signaling effect that the Board believes the shares are materially undervalued, and is willing to entertain higher offers.

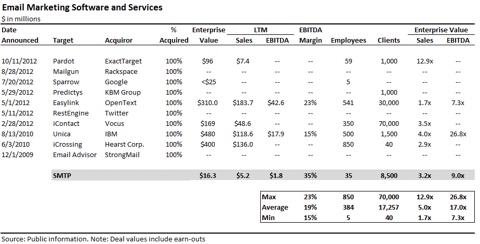

- A recent flurry of transactions in the email marketing and solutions space show the strategic value large corporations are placing on email and marketing tools to drive customer awareness and engagement. Recent acquirers include Google (GOOG), Twitter, Rackspace (RAX), ExactTarget (ET), OpenText (OTEX), IBM (IBM), Vocus (VOCS) and the Hearst Corp.

- A broad range of potential acquirers should increase the chances that SMTP is sold at an attractive premium; meanwhile, shareholders are paid to wait with a generous dividend yield.

SMTP's Value Proposition and Differentiation Points

SMTP provides services to enable small, medium and large businesses to outsource the sending of outbound emails. Senders of email use their services to help maintain their online email reputation so that their email is not blocked and is delivered to the intended recipients. The services are differentiated by level of computer, software and customer support resources provided, which is largely based on the volume of emails sent by customers:

- Business solution services are for small business users that send low volumes on an infrequent basis. These customers typically send between 500 and 200,000 emails each month and pay between $2 and $200 per month in fees (~90% of customers).

- Corporate solutions are for larger businesses requiring dedicated computer and software systems with advanced features, proactive reputation management and phone support. Their high volume corporate customers receive more powerful computer and software systems, high speed Internet connectivity, advanced email management features, 24/7 event monitoring and the highest levels of customer support. Corporate customers typically send from 200,000 to many millions of emails each month and pay between $200 and $10,000 per month. The average customer in this segment pays ~$450 per month (5% of total customers).

- High volume-dedicated solutions are for customers sending over 1m emails per month. The average paying customer in this segment will spend $1,000 - $5,000 per month and receives the highest level of counseling, support, and technology services (estimated <5% of customers).

SMTP's solution delivers both a technical and customer service aspect. From the technical side, emails outsourced to SMTP go through "reputable" IP addresses to ensure delivery to the inbox and monitor delivery issues. SMTP actively educates clients on how to maintain proper email lists and how to send emails, while working with ISPs and email providers to address resolutions to non-delivery issues.

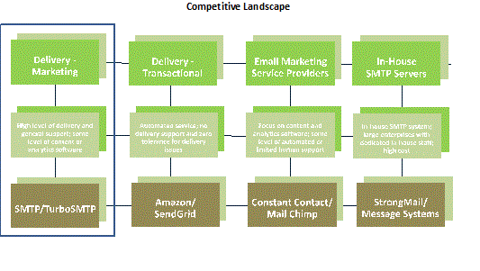

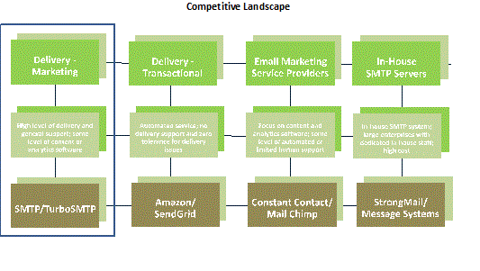

Competition is Intense but Fragmented

SMTP faces competition from three principal categories 1) in-house, do-it-yourself operators, 2) integrated solutions from email marketing companies and, 3) direct competition from infrastructure providers. Integrated solutions companies range from companies like ConstantContact (CTCT), ExactTarget (ET), MailChimp, and VerticalResponse. These are mostly one size fits all models, and have all customers on one IP address. For enterprise customers with large needs, even Amazon (AMZN) has entered the market with their "Simple Email Service" which allows customers to leverage their infrastructure at low cost, but with limited service, support, or add-on features. SendGrid.com is another example of an infrastructure provider. Some of SMTP's closer competitors are AuthSmtp.com, SMTP2Go.com, TurboSMTP.com, SocketLabs.com, and iContact.com.

(click to enlarge)

SMTP is Focused on Low Risk, Profitable Growth, and Will Reward Patient Shareholders

With an experienced management team and laser focus on growing the business, revenues have jumped from just $1.5 million in FY 2009 to $5.2 million as of LTM 9/30/12. All of the growth has been organic, and primarily from inbound lead generation. Given the company's simple, SaaS-like model, Gross and EBITDA margins are 77% and 35%, respectively as of LTM 9/30/12. The company's high EBITDA margins are a function of their extreme focus on cost discipline, while retaining a small entrepreneurial environment. SMTP has 25 - 35 contractors in the Ukraine that handle technical support, engineering, R&D, and other administrative functions. The core management team is based in Cambridge, MA.

The company is extremely capital efficient and has generated $900,000 of net income on average equity of $850,000 in the last twelve months. This translates into a Return on Equity of 106%. Free cash flow per share has historically approximated earnings per share. The company is managed in a conservative manner, and the management has articulated that they will not pursue acquisitions or unprofitable growth opportunities. Instead, the company will return excess cash to shareholders through regular and special dividends. Shareholders are currently being rewarded with a 6.3% dividend yield, while the business continues to grow organically, and the strategic evaluation occurs.

(click to enlarge)

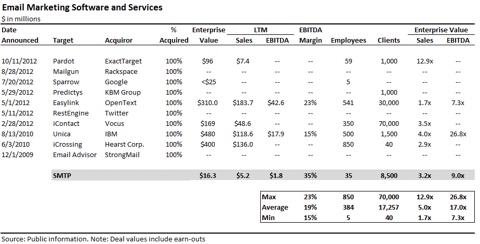

M&A Activity is Robust in the Marketing Services Space and Offers Upside Potential

In October 2012, SMTP announced that it retained Bowen Advisors to help it evaluate strategic alternatives for maximizing shareholder value. We believe this is a strong signal from the management and its Board that they believe their share price to be undervalued. It is easy to understand why this would be the case with the torrid pace of M&A activity in their markets, and modest valuation they are currently receiving. In addition to the various direct and adjacent competitors we discussed earlier that would be interested in evaluating SMTP as a target, there are a variety of other companies that have been acquisitive in the email marketing space. In just the past few months, Twitter acquired RestEngine, Rackspace acquired Mailgun, and Vocus acquired iContact. We believe these deals underscore the priority that companies are placing in using email services to connect and engage with customers in an increasingly competitive and slowing growth business environment. The table below summarizes recent transactions in the email marketing software and services sector.

(click to enlarge)

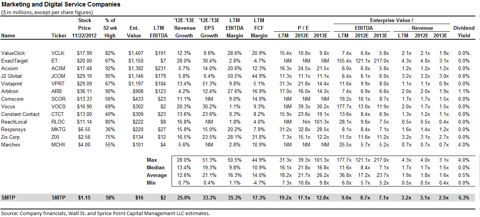

Current Valuation Leaves Room for Appreciation Even Without a Strategic Transaction

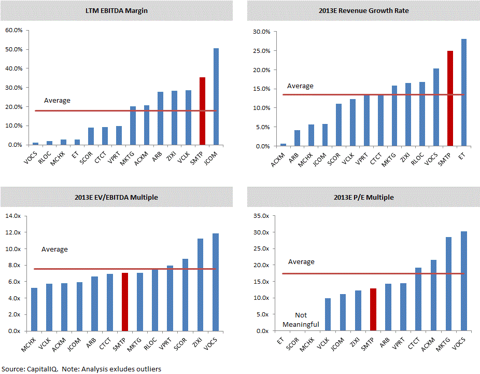

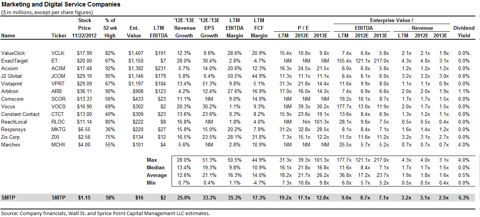

While there is no exact comparable company to SMTP, we have benchmarked their valuation against a broad range of marketing and digital software service companies such as Valueclick (VCLK) and Acxiom (ACXM), although closer comparables are likely ExactTarget, J2 Global (JCOM), ConstantContact (CTCT), Responsys (MKTG), ReachLocal (RLOC), and Zix Corp (ZIXI). In the table below, we have provided a full valuation comparison.

(click to enlarge)

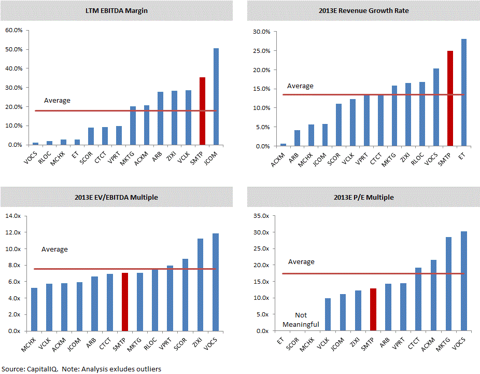

The key financial metrics and valuation comparison are best illustrated in the charts below. As can be seen, SMTP has above average margins and growth, yet trades at a valuation discount to peers, primarily as a result of its microcap discount and limited awareness of its investment merits and opportunities.

(click to enlarge)

Key Risk Factors to Consider

As a small company and microcap, there are numerous risks that investors should consider when evaluating SMTP. We've listed a few possible concerns, but for a complete list, potential investors should read the company's Risk Factor section in SMTP's annual report.

? Technology risk: As a technology company, the market for their services is competitive and rapidly changing, and has low barriers to entry. New technologies and new entrants to the market, could increase competition and harm their ability to increase sales, through lower customer additions, or lower product pricing.

? Contract risk: Customer contracts are short-term in nature (1 month to 1 year). The company must continually renew existing customers, and attract new ones to continue its historical growth.

? Search engine risk: SMTP relies heavily on search engines to attract customers, so changes in search algorithms and advertising prices could increase their costs and/or reduce their customer growth rate going forward.

? Shareholder concentration and microcap illiquidity: A majority of SMTP's shares are held by its Board and management team. Potential investors must get comfortable owning the company through periods of reduced liquidity, and comfortable with the management team that exercises control over the company's strategy.

Summary

For investors that can get comfortable owning shares in a small technology company in a large and fragmented industry, we believe that SMTP represents an attractive/risk reward at the current share price. The company's email marketing and delivery solutions address a large and fundamentally growing need for organizations to effectively deliver their email needs, at a cost-effective price, with minimal bounce rates. SMTP's base of over 8,500 customers, extremely low cost structure, and debt-free balance sheet help to mitigate some business and financial risk. Furthermore, investors are currently being rewarded with an attractive 6.3% dividend yield. At the current share price, the company is valued modestly at just 2.5x, 12.8x, and 7.1x 2013E sales, EPS and EBITDA, respectively. Our research suggests that M&A activity is accelerating in the email marketing solutions sector, with a broad range of large and small companies scrambling to broaden their offerings to customers. As a result, we believe SMTP could be attractive to a number of acquirers, and that investors are currently receiving a free call option on a value-enhancing transaction.

Disclaimer

Use of the research produced by Spruce Point Capital Management, LLC is at your own risk. The author of this report holds a long position in the security of SMTP, Inc. that will benefit from a rise in the price of the common stock. Following publication of the report, the author (including members, partners, affiliates, employees, consultants, or other shareholders) may transact in the securities of the companies covered herein. The author of this report has obtained all information contained herein from sources believed to be accurate and reliable and has included references where available and practical. However, such information is presented "as is," without warranty of any kind- whether express or implied. The author of this report makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Forward looking statement and projections are inherently susceptible to uncertainty and involve many risks (known and unknown) that could cause actual results to differ materially from expected results. All expressions of opinion are subject to change without notice, and the author does not undertake to update or supplement this report or any of the information contained herein. Spruce Point Capital Management, LLC has not accepted compensation from SMTP, Inc. to produce this report, is not a broker/dealer or financial advisor and nothing contained herein should be construed as an offer or solicitation to buy or sell any investment or security mentioned in this report. You should do your own research and due diligence before making any investment decision with respect to securities covered herein, including, but not limited to, the suitability of any transaction to your risk tolerance and investment objectives and consult your own tax, financial and legal experts as warranted

Source: http://seekingalpha.com/article/1026821-smtp-inc-a-high-growth-email-marketing-company-with-an-attractive-dividend-and-takeover-potential?source=feed

redskins Devon Walker Tom Cruise ryan reynolds Star Trek: The Original Series Carlton Morgan Freeman Dead

Jotting down weekly produce, dairy and cleaning supplies purchases on a scrap of paper is a thing of the past thanks to apps like Grocery IQ. This smart app for your smartphone and tablet device lets you create and replicate grocery lists very easily via text or voice-based instructions. The app offers millions of different brand name choices, so it?s unlikely it won?t be able to display your chosen items. Grocery IQ lets you share your lists with friends, family and roommates easily. A list can be originated on an iPhone, for instance, and later updated via and Android device or on the Grocery IQ website. Beyond offering added convenience, Grocery IQ will help you save money. The app offers an array of coupons, which can be printed or added to your store loyalty card.

Jotting down weekly produce, dairy and cleaning supplies purchases on a scrap of paper is a thing of the past thanks to apps like Grocery IQ. This smart app for your smartphone and tablet device lets you create and replicate grocery lists very easily via text or voice-based instructions. The app offers millions of different brand name choices, so it?s unlikely it won?t be able to display your chosen items. Grocery IQ lets you share your lists with friends, family and roommates easily. A list can be originated on an iPhone, for instance, and later updated via and Android device or on the Grocery IQ website. Beyond offering added convenience, Grocery IQ will help you save money. The app offers an array of coupons, which can be printed or added to your store loyalty card. Pushpins is another great grocery list building application that also showcases coupons related to the items you already plan to buy. Have peanut butter on your list? Look for a coupon for jelly. The app also includes aisle-sorting tools so you can arrange your list to how things are positioned at your favorite store. You can also access nutritional information and store circulars.

Pushpins is another great grocery list building application that also showcases coupons related to the items you already plan to buy. Have peanut butter on your list? Look for a coupon for jelly. The app also includes aisle-sorting tools so you can arrange your list to how things are positioned at your favorite store. You can also access nutritional information and store circulars. A decade ago, the news cycle for a CE product worked like this: a PR person contacted a major title - Laptop, say, or PC Magazine - and offered an exclusive for a cover story. "Hey," they'd say. "Hot new laptop coming out! It's got that new Wi-Fi!" An early version of the laptop would arrive at the title's office and someone would write a detailed review of it because, let's face it, there was little else to do at the office before the Internet was pervasive. Then, two months later the story would go to press and then maybe end up on some nascent Internet CMS hacked together by a designer after hours. The circle of life, then, for a tech product was about half a year. Plenty of time for back and forth, hand-holding, and handsome product shots.

A decade ago, the news cycle for a CE product worked like this: a PR person contacted a major title - Laptop, say, or PC Magazine - and offered an exclusive for a cover story. "Hey," they'd say. "Hot new laptop coming out! It's got that new Wi-Fi!" An early version of the laptop would arrive at the title's office and someone would write a detailed review of it because, let's face it, there was little else to do at the office before the Internet was pervasive. Then, two months later the story would go to press and then maybe end up on some nascent Internet CMS hacked together by a designer after hours. The circle of life, then, for a tech product was about half a year. Plenty of time for back and forth, hand-holding, and handsome product shots.

The Seoul Large Backpack from Kipling has laptop protection and padded shoulder straps making it great for travel or school. Main zipped compartment contains laptop pocket with Velcro closure, and a padded back and bottom panel. Zip-front pocket contains 2 pen sleeves, cell phone pocket, iPod/PDA pocket and large internal zippered pocket. Additional large zippered front pocket for more storage. Padded straps that are adjustable to a maximum length of 32 inches and top grip handle. Zippered pockets at the top and left hand side of bag are perfect for quick access to small items.

The Seoul Large Backpack from Kipling has laptop protection and padded shoulder straps making it great for travel or school. Main zipped compartment contains laptop pocket with Velcro closure, and a padded back and bottom panel. Zip-front pocket contains 2 pen sleeves, cell phone pocket, iPod/PDA pocket and large internal zippered pocket. Additional large zippered front pocket for more storage. Padded straps that are adjustable to a maximum length of 32 inches and top grip handle. Zippered pockets at the top and left hand side of bag are perfect for quick access to small items.